Well, one of those ledgers, or at least a dedicated section in one, would have been “The Journal”. It was a place to record transactions that didn’t fit anywhere else. There was a strict protocol for filling this out, largely abandoned these days, but the main thing is that all entries conformed to the central principle of double entry – where did it come from and where did it go to?

These days you will hear accountants and bookkeepers talk about “journals” i.e. in the plural, but this is short for “journal entries”, or they might say something like “You need to do a journal for that” meaning you need to account for something by making a journal entry. Each journal entry would have a debit and a credit, sometimes more than one (but always balancing) along with the date of the entry and a description of what it was for. This was a record of the individual entries that would be made in the various other ledgers.

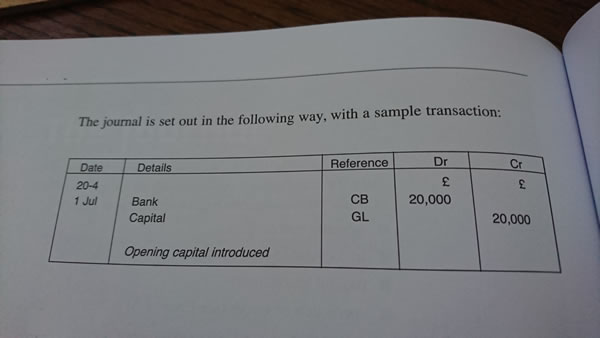

The image above shows a journal for the initial Capital introduced into the business but here’s another example…

You discover that you have been coding a series of invoices from the council to the “Business Rates” nominal account, but having looked into it, five of them are for £11 of waste collection and not rates at all. Rather than correct each individual entry, you can make a journal entry as follows:

Debit Waste Collection account £55

Credit Business Rates account £55

Being reallocation of waste collection costs incorrectly recorded as rates.

You can see the double entry very clearly – the money is coming from Business Rates and going to Waste Collection, and a clear trail or “account” of the transaction is there for all to see.

Most software packages will have a journal entry function (although some hide it so that only your accountant can use it) and in all cases the basic requirements will be a date, and debits and credits that balance out. There will also be a memo function for describing what the journal entry is for.

So that’s it, The Journal, no mystery! You may never make a journal entry, but at least you now know what they are.